Mason had always been a fan of technology, so when he heard about the booming world of cryptocurrency, he was eager to get involved. After a few hours of reading articles and watching YouTube videos, he felt confident. “How hard can it be?” he thought. Armed with a basic understanding of blockchain and a few buzzwords he picked up, he created an account on a trading platform and started buying cryptocurrencies based on trending recommendations.

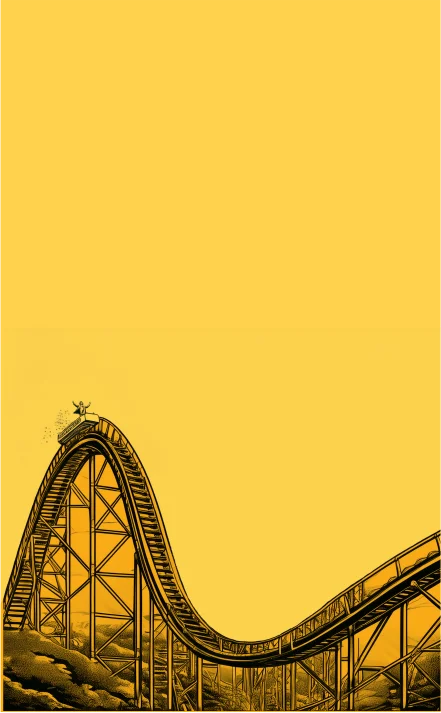

At first, things seemed to be going well. His investments rose a bit, and Mason felt vindicated. “I’m a natural at this,” he thought, feeling proud of his ability to navigate the digital currency world with ease. He started sharing his “expert” opinions on social media, advising friends and family to get involved too.

However, as the weeks passed, Mason’s confidence began to falter. His portfolio, once profitable, began to dip. He realized that he didn’t truly understand the fluctuations of the market, the technical analysis, or the risks involved in cryptocurrency investments. His initial research was far from comprehensive, and the market’s complexity became painfully clear to him.

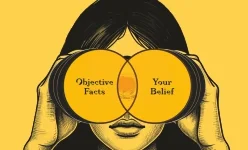

Yet, despite this realization, Mason still couldn’t see how much more he needed to learn. He blamed the market for being unpredictable rather than recognizing that his understanding of it was superficial. In his mind, he was still just as capable as he had been at the start, unable to fully grasp how much expertise was required to succeed.

The Dunning-Kruger effect suggests that when people with limited knowledge or experience in a subject overestimate their understanding, it leads them to make decisions that underestimate the complexities involved.