Amit had never considered himself an expert in stock trading, but one day, he decided to take a chance. After reading a few online articles and watching some videos, he invested a significant amount of money in a rising tech startup. Within months, the stock skyrocketed, tripling his investment.

Looking back, Amit convinced himself that he had seen the potential all along. “I knew this company was going to take off,” he told his friends. “It was obvious from the start.” Encouraged by his success, he began investing more aggressively, believing he had a natural talent for picking winning stocks.

However, his next few investments didn’t go as planned. The companies he bet on struggled, and he lost more money than he had made. Confused, he revisited his earlier success. The truth was, he hadn’t analyzed the market deeply or made a strategic decision—he had simply been lucky. But hindsight bias made him believe his past success was due to skill, not chance.

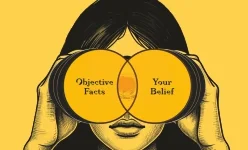

Hindsight Bias highlights the tendency to look back at past events and believe they were more predictable than they actually were. Because his first investment was successful, he assumed he had always known it would be. This overconfidence led him to ignore the role of luck and take bigger risks, ultimately resulting in losses. Recognizing hindsight bias helps us make more measured decisions instead of assuming past success guarantees future results.