UX Design for Fintech: An Expert's Guide

Looking ahead, one thing is clear: exceptional UX design is not merely an option—it’s essential for businesses aiming to capture and retain users in today’s rapidly evolving fintech landscape. This guide will explore the key components, best practices, and emerging trends crucial for mastering fintech UX design and differentiating your application from the competition.

CONTENTS

What is Fintech UX Design?What Sets Leading Fintech UX Design ApartHow UX Design Drives Success in FintechValue Proposition of Investing in Fintech UX DesignBest Practices in Designing Fintech UXDesigning for Tomorrow’s Success: Trends Shaping Fintech UXTransform Your Fintech Application Success with Monsoonfish Approach to Seamless UXSocial Share

CATEGORIES

In a market where 80% of banks now offer similar functionalities, distinguishing your fintech application can be challenging. The key? Crafting a user experience that is not just functional but exceptionally intuitive, engaging, and delightful.

The fintech sector is on an unprecedented growth trajectory. According to a recent report by Grand View Research, the global fintech as a service market size was estimated at USD 266.56 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.5% from 2023 to 2030. With fintech startups proliferating, estimated at over 30,000 worldwide, the pressure is on to stand out.

What is Fintech UX Design?

Fintech, or financial technology, represents a broad spectrum of innovations aimed at enhancing financial services through technology. From the rise of mobile banking apps and digital wallets to the evolving world of cryptocurrencies and robo-advisors, fintech is reshaping how we interact with money. As these technologies continue to advance, the need for intuitive and user-friendly design becomes increasingly critical.

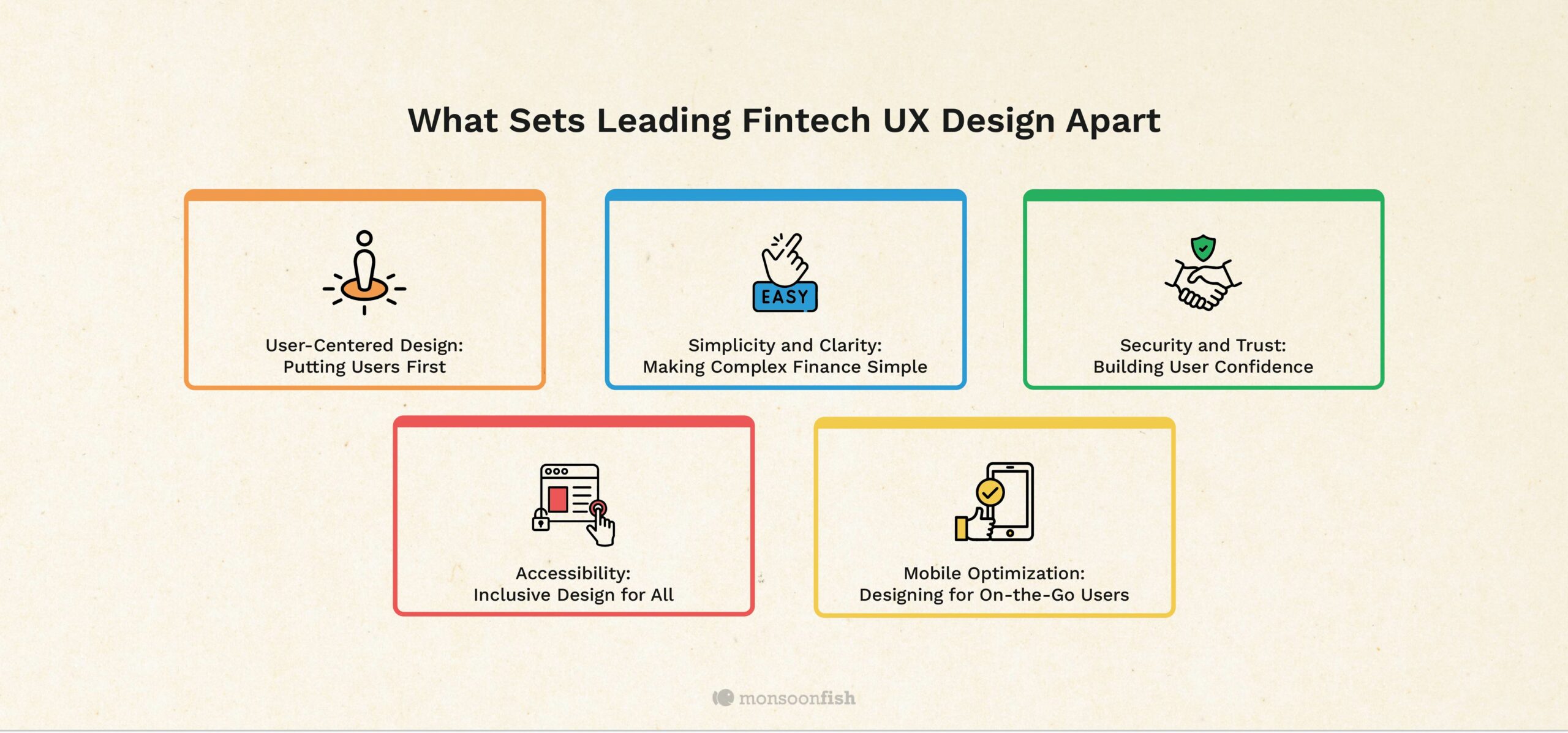

What Sets Leading Fintech UX Design Apart

To create a successful fintech application, it is essential to focus on key UX design components that ensure a seamless and engaging user experience. The following elements are critical for developing an intuitive and effective fintech product.

User-Centered Design: Putting Users First

At the core of any successful fintech application is user-centered design. This approach prioritizes the needs, preferences, and behaviors of users, ensuring that the product is tailored to provide a seamless experience. Understanding your user base through research and personas is vital.

Simplicity and Clarity: Making Complex Finance Simple

In the complex world of finance, simplicity and clarity are crucial. Users should be able to navigate the application effortlessly, understand their options, and complete transactions without confusion. Clear visual hierarchy and straightforward language are key elements in achieving this.

Security and Trust: Building User Confidence

Given the sensitive nature of financial information, security and trust are paramount in fintech UX design. Implementing robust security measures and transparently communicating these to users helps build confidence in the application.

Accessibility: Inclusive Design for All

Ensuring that fintech applications are accessible to all users, including those with disabilities, is both a legal requirement and a moral imperative. Designing for accessibility means considering factors such as screen reader compatibility, color contrast, and keyboard navigation.

Mobile Optimization: Designing for On-the-Go Users

With a significant portion of users accessing fintech services via mobile devices, optimizing for mobile is non-negotiable. A responsive design that adapts seamlessly to different screen sizes and resolutions is essential for providing a consistent user experience.

The best fintech ux design agencies focus on these key elements to create applications that not only meet user expectations but also drive satisfaction and engagement.

How UX Design Drives Success in Fintech

Effective UX design is pivotal in fintech, not just for aesthetics but for functionality and user engagement.

For instance, a well-designed mobile banking app can lead to a 30% increase in user retention rates and a 20% boost in transaction volumes.

By minimizing user errors and enhancing overall satisfaction, fintech companies can build a strong reputation and foster long-term customer trust.

- Enhancing User Satisfaction and Retention: A well-designed fintech application enhances user satisfaction by providing a smooth and enjoyable experience. Satisfied users are more likely to remain loyal and recommend the app to others, leading to increased retention rates.

- Reducing User Errors and Increasing Efficiency: Intuitive design minimizes the likelihood of user errors, making it easier for users to complete transactions accurately and efficiently. This not only improves user satisfaction but also reduces the need for customer support.

- Impact on Brand Reputation and Customer Trust: A positive user experience directly impacts a brand’s reputation and fosters customer trust. In the competitive fintech landscape, a reputation for providing an excellent user experience can be a significant differentiator.

Investing in superior UX design is essential for fintech companies looking to enhance user satisfaction, reduce errors, and build a trusted brand. By prioritizing UX design, fintech companies can achieve long-term success and stand out in a crowded market.

Value Proposition of Investing in Fintech UX Design

A well-executed UX design is a critical factor in the success of fintech applications. By prioritizing user experience, fintech companies can unlock a multitude of benefits that drive growth, efficiency, and user satisfaction. Here are some of the key advantages of investing in superior fintech UX design.

- Increased Adoption Rates: A user-friendly fintech application is more likely to attract new users and encourage existing ones to explore additional features, leading to increased adoption rates. Applications with intuitive designs see a 25% higher rate of user adoption.

- Competitive Advantage: In the crowded fintech market, a superior user experience can provide a competitive edge. Companies that invest in UX design are better positioned to stand out and capture market share. Superior UX can position your company ahead of competitors, capturing 15% more market share.

- Higher Conversion Rates: Streamlined user journeys can boost conversion rates by up to 35%. Optimized user journeys and clear calls to action can significantly boost conversion rates, turning visitors into loyal customers.

- Compliance and Security: Effective UX design ensures compliance with regulatory requirements and incorporates robust security features, safeguarding user data and maintaining trust.

- Customer Support Reduction: A well-designed fintech application reduces the need for customer support by providing clear instructions and minimizing the likelihood of user errors.

- Improved Accessibility: By designing for accessibility, fintech companies can reach a broader audience and ensure that all users have a positive experience, regardless of their abilities.

The benefits of a good fintech UX design encompass increased user adoption, competitive advantage, higher conversion rates, compliance, security, reduced customer support needs, and improved accessibility. By focusing on these aspects, fintech companies can create applications that not only meet but exceed user expectations, driving long-term success and user satisfaction.

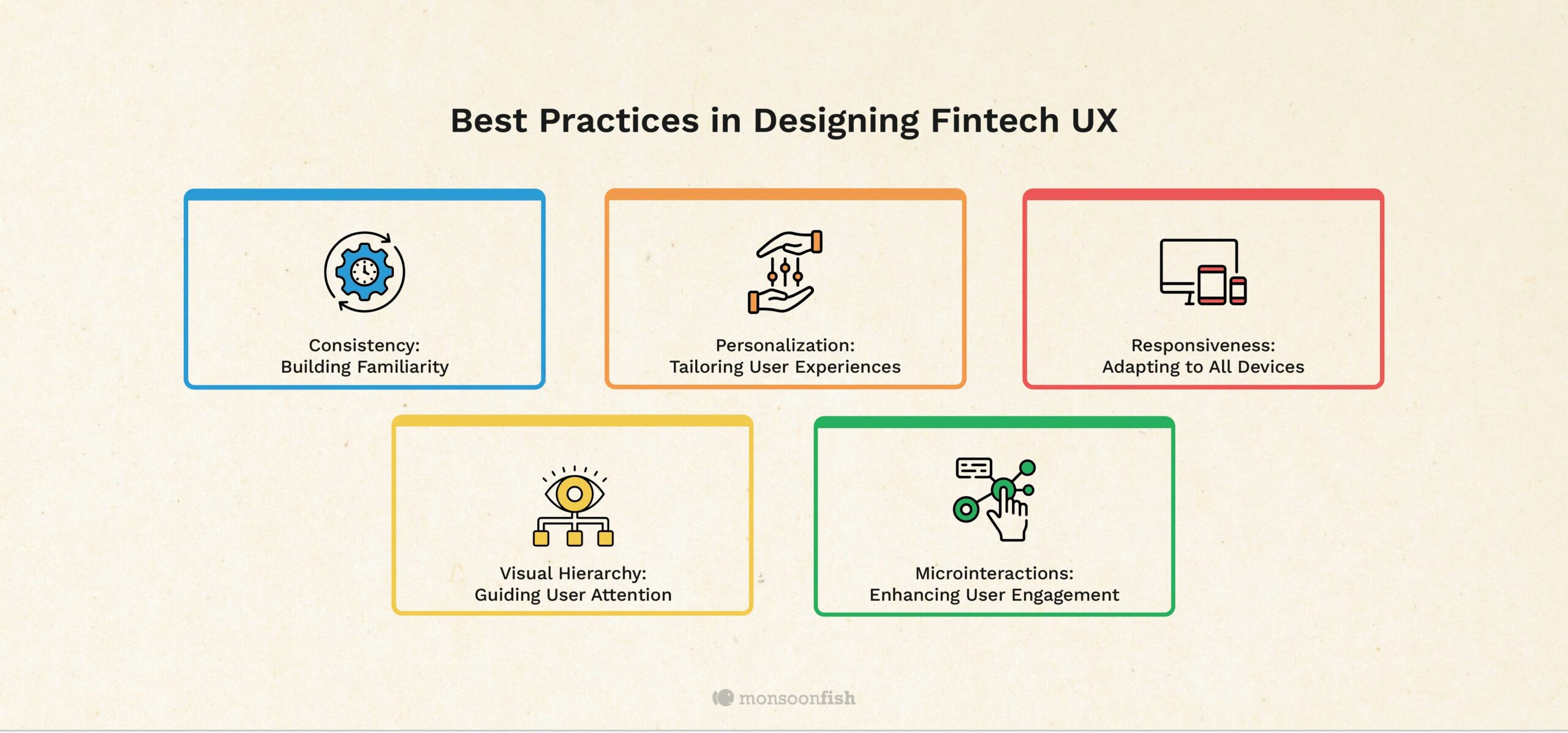

Best Practices in Designing Fintech UX

To stay ahead in the rapidly evolving fintech landscape, embracing emerging trends is essential. AI and machine learning enable predictive analytics and personalized experiences, while blockchain ensures secure and transparent transactions. Voice and chatbot interfaces offer a conversational approach to banking, and biometric authentication enhances security with ease. Augmented and virtual reality provide immersive financial experiences that can transform user interactions.

Consistency: Building Familiarity

Consistency in design elements such as typography, color schemes, and iconography helps create a cohesive user experience. This uniformity makes it easier for users to navigate the application and understand its functionalities.

Personalization: Tailoring User Experiences

Personalization enhances the user experience by tailoring content and features to individual preferences and behaviors. Implementing personalized dashboards, notifications, and recommendations can significantly improve user engagement.

Responsiveness: Adapting to All Devices

Responsive design ensures that the application functions smoothly across various devices and screen sizes. This adaptability is crucial in providing a consistent user experience, whether users are accessing the app on a desktop, tablet, or smartphone.

Visual Hierarchy: Guiding User Attention

A clear visual hierarchy guides users through the application, highlighting important information and actions. Effective use of contrast, spacing, and typography helps users quickly identify and prioritize key elements.

Microinteractions: Enhancing User Engagement

Microinteractions, such as animations and feedback messages, enhance the user experience by providing instant feedback and creating a sense of interactivity. These small design elements can make a big difference in user satisfaction.

Incorporating these best practices into fintech UX design can lead to a more intuitive, engaging, and effective application. By focusing on consistency, personalization, responsiveness, visual hierarchy, and microinteractions, fintech companies can create applications that meet user needs and exceed expectations.

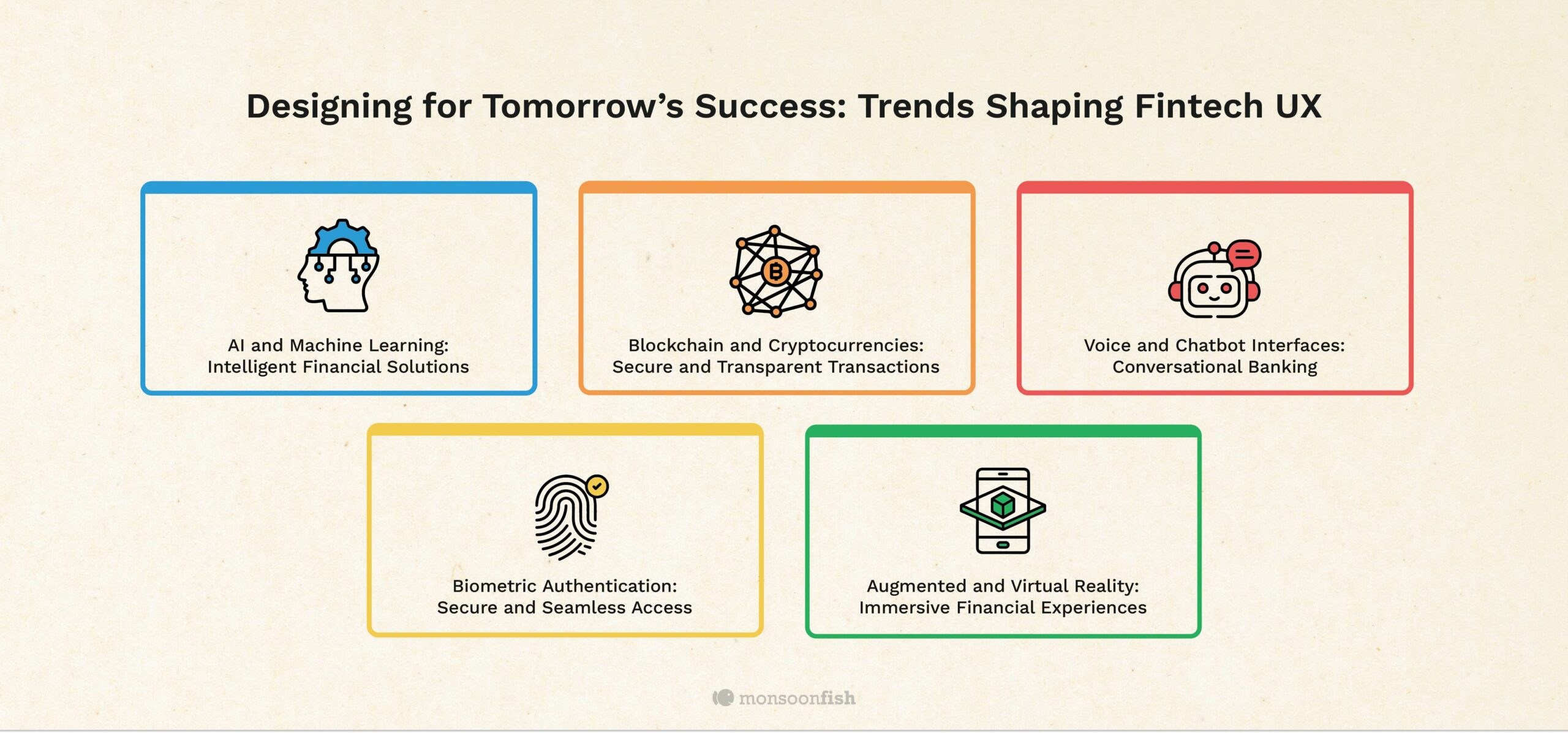

Designing for Tomorrow’s Success: Trends Shaping Fintech UX

To stay ahead in the rapidly evolving fintech landscape, embracing emerging trends is essential. AI and machine learning enable predictive analytics and personalized experiences, while blockchain ensures secure and transparent transactions. Voice and chatbot interfaces offer a conversational approach to banking, and biometric authentication enhances security with ease. Augmented and virtual reality provide immersive financial experiences that can transform user interactions.

AI and Machine Learning: Intelligent Financial Solutions

Artificial intelligence and machine learning are transforming fintech applications by enabling personalized experiences, predictive analytics, and intelligent automation. These technologies can enhance user experience by providing tailored recommendations and proactive support.

Blockchain and Cryptocurrencies: Secure and Transparent Transactions

The rise of blockchain and cryptocurrencies is driving innovation in fintech UX design. As these technologies become more mainstream, designers must create intuitive interfaces that demystify complex concepts and ensure secure transactions.

Voice and Chatbot Interfaces: Conversational Banking

Voice and chatbot interfaces are becoming increasingly popular in fintech applications, offering users a convenient and conversational way to interact with their finances. Designing for these interfaces requires a focus on natural language processing and user-friendly dialogue flows.

Biometric Authentication: Secure and Seamless Access

Biometric authentication methods, such as fingerprint and facial recognition, provide a secure and convenient way for users to access their accounts. Incorporating these technologies into fintech applications enhances security while simplifying the user experience.

Augmented and Virtual Reality: Immersive Financial Experiences

Augmented and virtual reality are emerging trends that have the potential to revolutionize fintech UX design. These technologies can provide immersive and interactive experiences, such as virtual financial planning sessions or augmented reality visualizations of investment portfolios.

By following these best practices, fintech companies can create applications that are not only functional but also enjoyable to use. Consistency, personalization, responsiveness, visual hierarchy, and microinteractions are key elements that contribute to a superior user experience, driving user satisfaction and loyalty.

Transform Your Fintech Application Success with Monsoonfish Approach to Seamless UX

At Monsoonfish, we specialize in crafting user-centric designs that drive engagement and satisfaction. Our expertise in fintech UX design ensures that your application not only meets but exceeds user expectations.

Partner with us to create seamless, secure, and enjoyable fintech experiences that set your brand apart in the competitive market.

CATEGORIES